CONNECTING THE DOTS: NIIC position, US reliance on external capital, Renewable energy hostility from Mr. Trump, And the bond market.

US NIIC position, US reliance on external capital,

Renewable energy hostility from Mr. Trump,

And the bond market.

The net capital position of the US, the vociferous opposition of Donald Trump toward renewable energy and EVs around the world, and the bond market are directly linked.

And that’s why we said earlier that the situation of the US NIIC position is a little worse than Mr. Varoufakis was explaining, because he did not take into account what’s going on with USD-denominated fuels in terms of substitution.

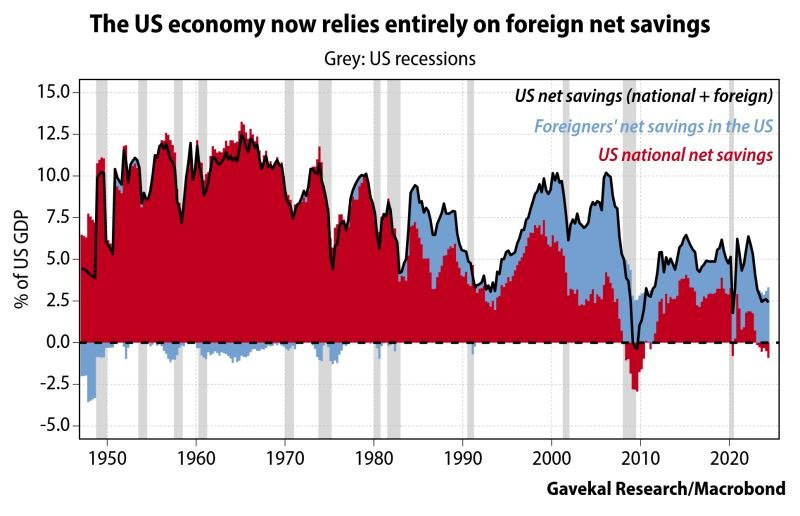

This is the NIIC position presented by GaveKal a couple of quarters ago.

h/t @Gavekal

And here was the text associated with it:

“Americans are consuming more capital than they produce. US national net savings by households, businesses and the government have been negative since 1Q23, for only the third time since 1947. The other two times were 2008-11 and 2020.

The reason for this latest contraction is that an increase in private sector net savings has failed to offset the sharp rise in the government budget deficit. Fortunately, foreigners are still accumulating savings in the US, but will they continue to willingly pile into US assets if the US dollar keeps falling against other major currencies?” – GaveKal

UPDATED SITUATION ON NIIC

The net savings of the US is basically this in national accounting:

US National Net Savings (% of GDP) = Private Savings (% of GDP) − Government Budget Deficit (% of GDP)

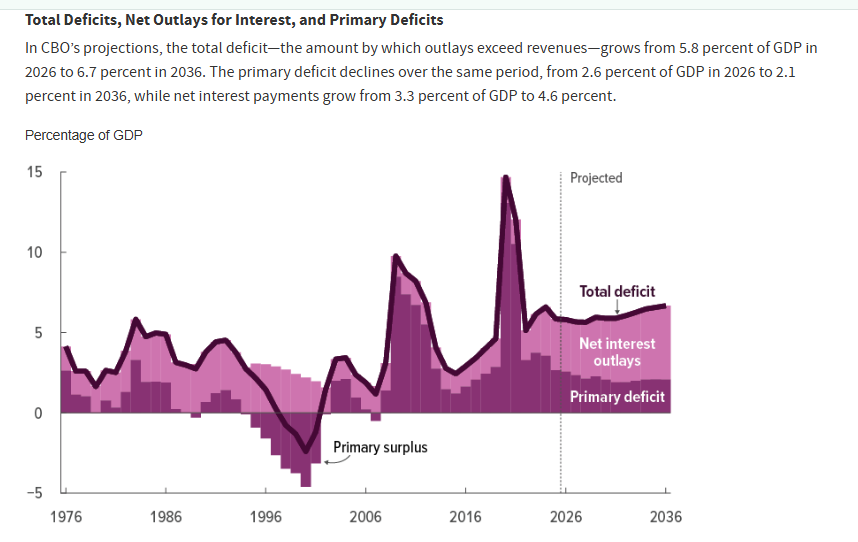

So what’s the updated situation on the government deficit (as of 2 days ago from the CBO)?

https://www.cbo.gov/publication/62105

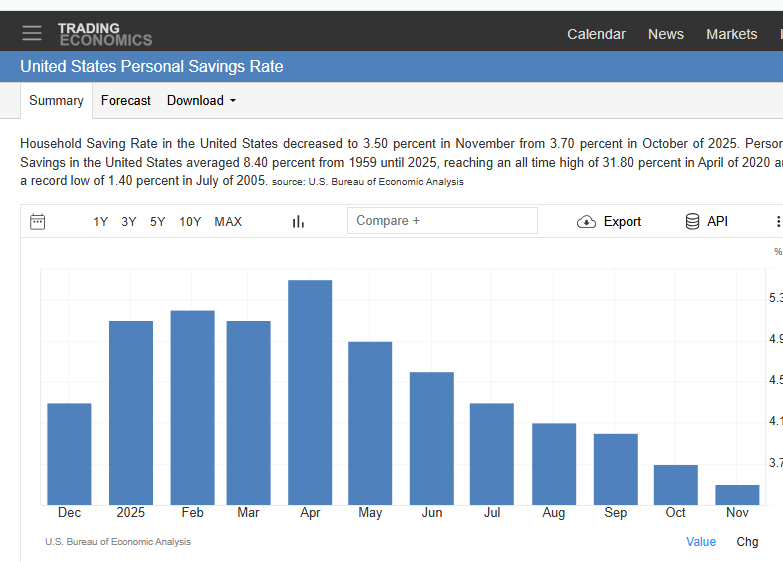

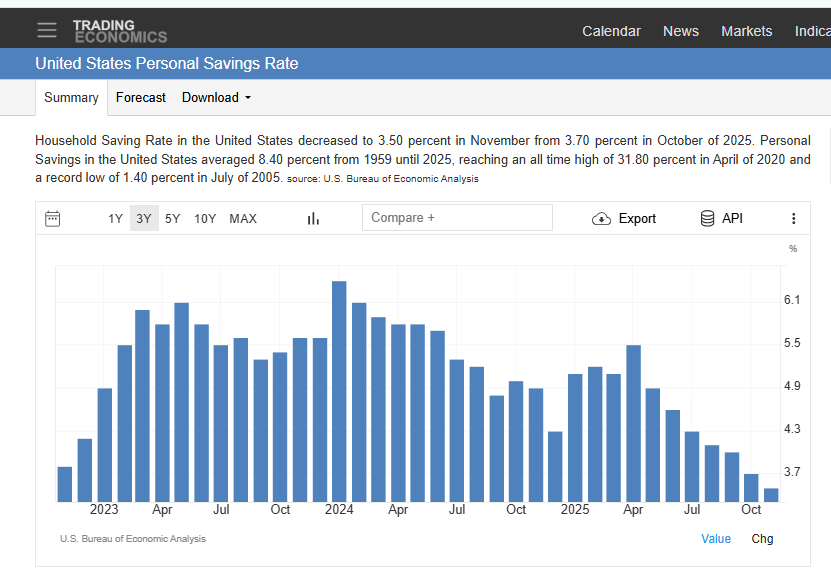

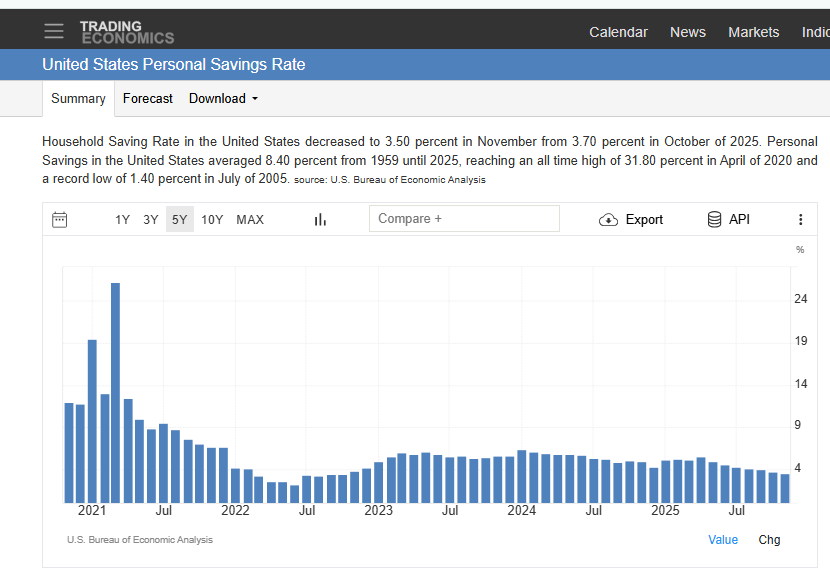

And what is the update on private savings?

You can look at it either on a monthly basis,

Or over a longer time horizon.

Either way you look at it, it is falling.

The dependence on foreign capital is not getting better.

So obviously, you need foreigners to continue to plug the gap.

But what does the vociferous hostility toward renewables and EVs have to do with the NIIC?

Well, you need foreign capital to plug the hole.

HAVE YOU EVER HEARD OF THE PETRO-DOLLAR AND PETROGAS?

It’s relatively simple to understand.

If oil is priced in USD, and gas is priced in USD, AND IF YOU NEED TO BUY IT (and I insist on the IF very much!!!),

Then global demand for USD is structurally supported.

PETRO-DOLLAR

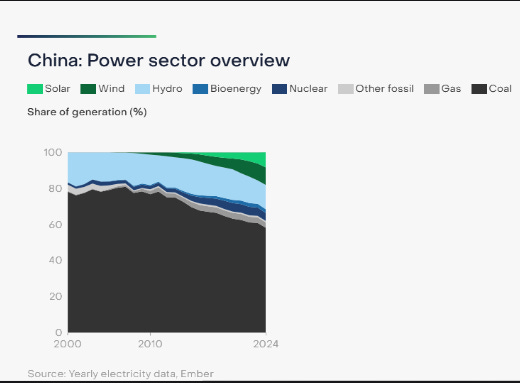

That’s what’s happening with the petrodollar dynamics in China with gasoline and total oil demand.

Here is a more detailed discussion about demand for $Oil:

GAS-DOLLAR IN MEXICO (largest client of US natural gas)

The private sector is shifting to solar and storage off-grid, made possible by the Sheinbaum 20 MW self-production exemption.

Basically, electricity from the grid powered by natural gas is not competitive versus solar and storage off-grid in Mexico — and not by a small amount.

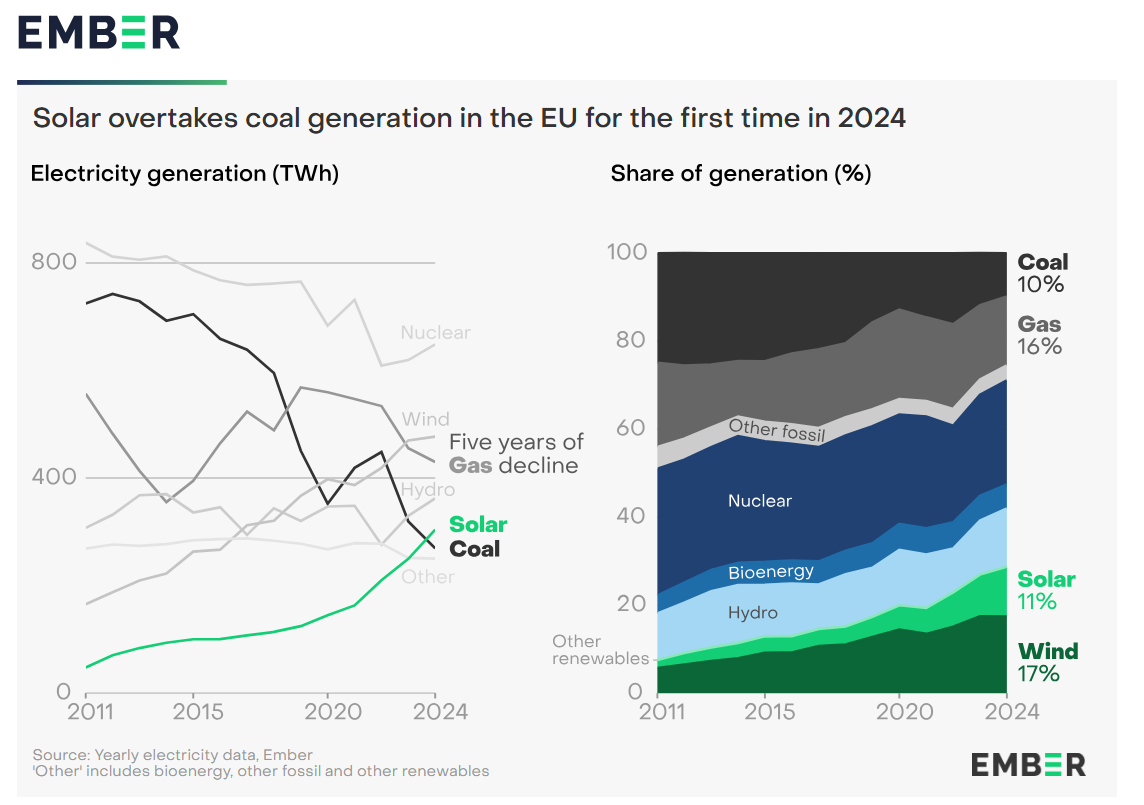

GAS-DOLLAR IN EUROPE

Natural gas demand has been declining for five years, while renewables have been ramping up.

HOSTILITY FROM TRUMP

Here you can see the hostility of Donald Trump.

Why would he care about the well-being of Germany’s power system? He does not. He cares about the problem of foreign capital absorption into US debt, which is impaired by renewables reducing USD-denominated energy demand.

HINT: If your power is generated by Vestas Gamesa-Siemens wind turbines, there is no need for USD-denominated gas.

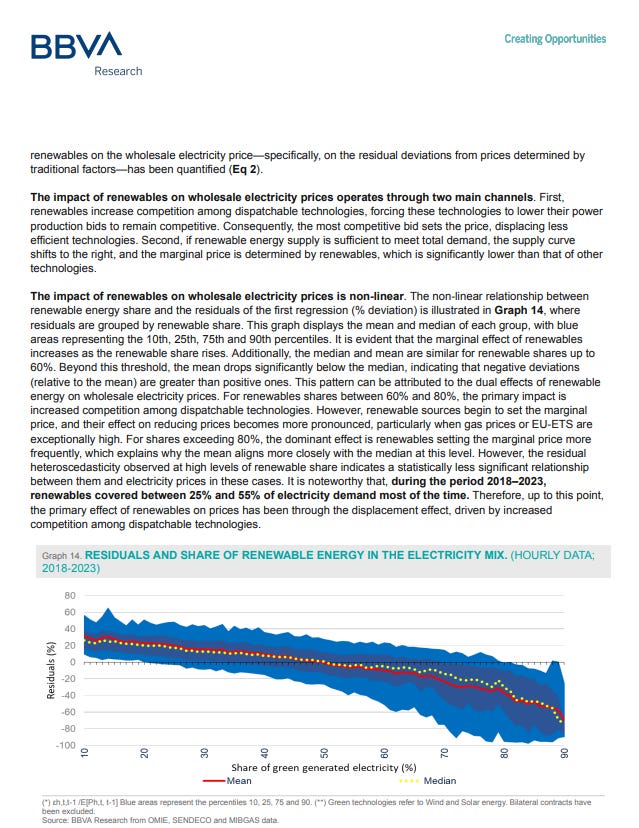

And that’s exactly what happened in Spain. The boom in solar panels suppressed both the demand for natural gas and wholesale electricity prices.

In the UK, the rise in renewable capacity combined with windy weather has started to suppress demand for natural gas, with mechanical effects on wholesale electricity prices.

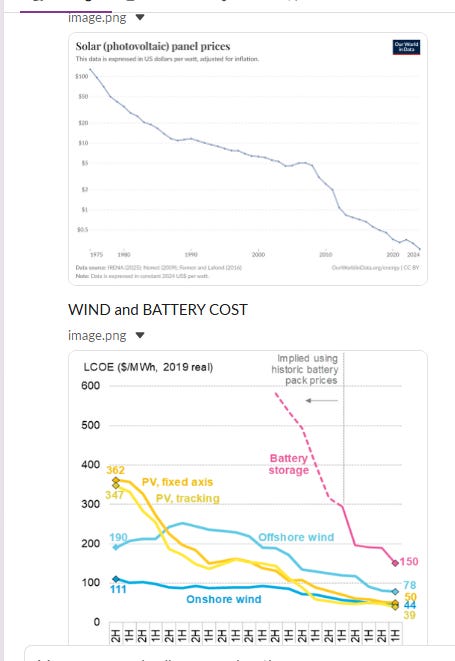

LCOE in offshore wind is plunging, and even LCOS now makes renewables competitive, as shown in Mexico and more broadly.

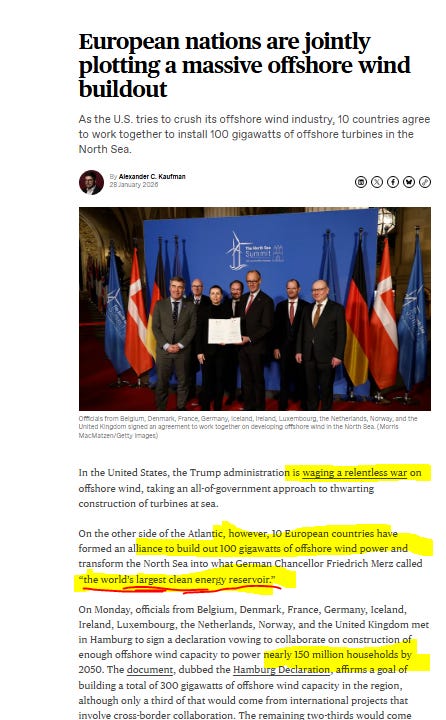

So look no further for Trump’s hostility toward offshore wind, which could supply 40% of Europe’s energy needs and would mechanically continue the decline in natural gas imports into Europe.

But the plans have already been set in motion.

Trump can do Trump — “whatever” is the response from those countries — as offshore wind could power 150 million households.

And look no further for the hostility on Twitter from certain accounts toward renewable policies in Europe and elsewhere.

If 150 million households can be powered by offshore wind — powering both their homes and their cars — where is the demand for LNG?

What happens to demand for $Oil — remember the petrodollar and gas-dollar system?

They are in trouble.

@MichaelAArouet @7Kiwi @ekwufinance @JunkScience @aeberman12 @KathrynPorter26

Those accounts have tried to argue that renewables are more expensive, which is demonstrably false, especially with grid battery costs plunging by 60% in two years.

Those accounts also try to shift the narrative that China is ignoring renewables and pushing fossil fuels, and this narrative is now falling apart, as shown in this previous post:

The transition is now moving into mining and vertical integration into smelting, most notably in Australia with Fortescue Metals, but also in Chile. Fortescue is moving to cold green smelting and explaining hwo their pilbara operations are now powered by renewables, and it’s not because they are tree huggers. HINT: MONEY/ SAVINGS / LONG TERM COMPETITIVENESS

https://australianminingreview.com.au/news/fortescue-green-metal-project-boosted-by-metso/

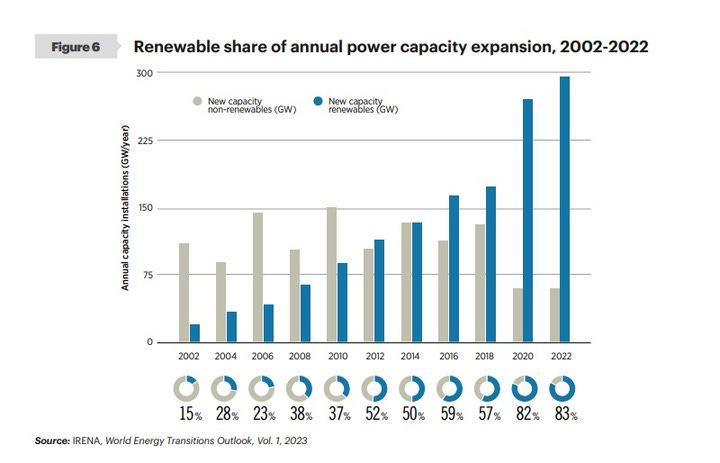

The energy transition was supposed to be slow and costly.

But with progress in battery costs and rapidly declining solar PV costs due to perovskite solar, the energy transition is proving to be a transition toward CHEAP ENERGY, as shown in Australia and elsewhere.

When energy becomes cheaper, the pace is no longer slow.

It becomes “catastrophically fast.”

Installing rooftop solar can offer strong financial returns — many Australian homeowners save upwards of AU$1,000–1,500 per year on bills after installing solar and batteries.

The Ukraine war created bottlenecks not for solar nor onshore wind so much, but for offshore wind.

However, government commitments are bringing cost relief in infrastructure, and continuous learning curves in turbine manufacturing and installation vessels mean that the largest operators are committing to decrease offshore wind costs by one-third or more over the next 10–15 years.

Now, connecting the dots to the NIIC of the US and the role fossil fuels played in supporting dollar demand:

There will be winners and losers in currency terms.

On one hand, some countries will reduce their energy bills by cutting USD-denominated fuel imports for transportation and power.

On the other hand, some countries still depend on those exports to support their national budgets and currencies.